Mold Remediation in Eagle Point, OR

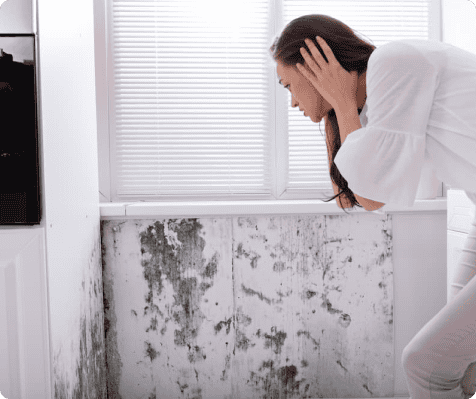

Mold Remediation in Eagle Point is essential for maintaining a healthy living environment. Mold can develop quickly in damp areas, posing serious health risks to you and your family. Whether it's due to a leaky roof, flooding, or high humidity, addressing mold issues promptly is crucial to prevent further damage to your property and ensure the safety of your loved ones.

At Disaster Response, we understand the urgency of mold problems. Our team of experts is equipped with the latest technology and techniques to identify and eliminate mold effectively. We conduct thorough inspections to assess the extent of the mold growth and develop a tailored remediation plan that addresses your specific needs. Our goal is to restore your home to a safe and healthy condition as quickly as possible.

Mold can not only damage your property but also lead to various health issues, including respiratory problems and allergies. That's why our mold remediation services in Eagle Point focus on not just removing the visible mold but also addressing the underlying moisture issues that allow mold to thrive. We take a comprehensive approach to ensure that your home is not only mold-free but also protected against future infestations.

Choosing Disaster Response means you're opting for professionalism and expertise in mold remediation. Our dedicated team is committed to providing exceptional service, ensuring that your home is safe and comfortable. Don't let mold compromise your health and property—contact us today for a thorough assessment and effective remediation solutions tailored to your needs.

- Disaster Response: The Authority on Eagle Point Mold Remediation

- Disaster Response: The Leading Authority on Mold Remediation in Eagle Point

- Mold Testing and Remediation Overview: Following IICRC S520 Standards

- Do You Really Need a Mold Remediation Expert in Eagle Point?

- Reach Out to a Mold Remediation Specialist in Eagle Point, OR, for These Mold-Related Issues

- Essential Steps to Take After Discovering Mold in Your Home in Eagle Point

Disaster Response, The Authority on Eagle Point Mold Remediation

Finding a reliable mold remediation service in Eagle Point, OR, can be overwhelming, but with Disaster Response, the choice becomes clear. With years of experience in the industry, we specialize in effectively eliminating mold and restoring your home or business to a safe environment. Our dedicated team understands the health risks associated with mold exposure and is committed to providing thorough and efficient remediation services.

At Disaster Response, we utilize advanced techniques and state-of-the-art equipment to identify and remove mold from your property. Our experts conduct comprehensive inspections to assess the extent of the mold problem, ensuring that no hidden spores are left behind. We prioritize your safety and well-being, employing environmentally friendly products that are safe for both your family and the planet.

Our commitment to excellence extends beyond just mold removal. We also focus on preventing future mold growth by addressing the underlying causes, such as moisture issues and inadequate ventilation. Our team provides valuable advice on maintaining a mold-free environment, empowering you to take proactive steps in safeguarding your property.

Like the iconic landmarks in Eagle Point, OR, we stand as a beacon of hope for those facing mold challenges. Our expertise and dedication to customer satisfaction set us apart in the mold remediation industry.

As true specialists in Eagle Point mold remediation, we focus exclusively on the following services

- Comprehensive Mold Inspections

- Mold Removal and Cleanup

- Air Quality Testing

- Moisture Control Solutions

- Preventative Treatments

- Structural Drying and Dehumidification

- Post-Remediation Verification

- Emergency Response Services

- Residential and Commercial Services

- Consultation and Education on Mold Prevention

At Disaster Response, we strive to be THE authority on mold remediation in Eagle Point. We understand the urgency of addressing mold issues and are here to provide swift, effective solutions. When you choose our services, you can trust that we will restore your space to a safe and healthy condition, allowing you to breathe easy once again.

Disaster Response: The Leading Authority on Mold Remediation in Eagle Point

Finding a reliable mold remediation service in Eagle Point can be overwhelming, but with Disaster Response, the choice is clear. With years of experience in the industry, we specialize in effectively identifying and eliminating mold issues, ensuring a safe and healthy environment for our clients. Our dedicated team understands the complexities of mold growth and is committed to providing top-notch service tailored to your specific needs.

At Disaster Response, we utilize advanced techniques and state-of-the-art equipment to assess and remediate mold infestations. Our experts are trained to handle various types of mold, from common household varieties to more hazardous species, ensuring that your property is thoroughly treated. We prioritize safety and efficiency, working diligently to restore your space to its original condition while minimizing disruption to your daily life.

Our comprehensive approach includes not only the removal of mold but also addressing the underlying causes of moisture that contribute to its growth. We believe in educating our clients about mold prevention and maintenance, empowering them to take proactive steps in safeguarding their homes or businesses. With our commitment to excellence, you can trust that your mold remediation project is in capable hands.

As a leading provider of mold remediation services in Eagle Point, we pride ourselves on our customer-centric approach. We understand that dealing with mold can be stressful, which is why we strive to make the process as seamless as possible. Our team is here to guide you every step of the way, ensuring that you feel supported and informed throughout the entire remediation process.

- Comprehensive Mold Inspections

- Mold Removal and Cleanup

- Air Quality Testing

- Moisture Control Solutions

- Preventative Treatments

- Structural Drying and Dehumidification

- Post-Remediation Verification

- Emergency Response Services

- Residential and Commercial Services

- Consultation and Education on Mold Prevention

At Disaster Response, we are dedicated to being the leading authority on mold remediation in Eagle Point. Our expertise and commitment to customer satisfaction set us apart in the industry. When you choose us, you can rest assured that we will restore your property to a safe and healthy state, allowing you to breathe easy once again.

Mold Testing and Remediation Overview: Following IICRC S520 Standards

The IICRC S520 standard provides a clear guide for safely managing mold issues in homes and buildings. Its main goals are to protect people, ensure thorough cleanup, and prevent future mold problems.

1. Assessment and Inspection

Initial Assessment:

- Trained professionals will conduct a detailed inspection of the affected area. This includes visual checks and using tools like moisture meters and infrared cameras to find hidden mold or moisture.

- Understanding moisture sources is crucial, as mold often arises from water issues or high humidity.

Mold Sampling:

- Although not always needed, testing (both air and surface samples) can help identify the type and amount of mold present.

- Sampling is useful when mold is suspected but not visible, such as when there are odors or health concerns.

- If sampling is done, it must follow proper protocols, with analysis performed by accredited labs.

2. Containment Protocols

Containment Procedures:

- To stop mold spores from spreading during cleanup, barriers (like plastic sheeting and negative air pressure) are used.

- The extent of containment varies; small areas might require basic barriers, while larger or heavily contaminated spaces need more extensive containment.

- Workers must enter and exit through decontamination chambers to avoid spreading mold.

3. Personal Protective Equipment (PPE)

- Workers should wear appropriate PPE, including gloves, N95 masks, full-body suits, and eye protection.

- The type of PPE needed depends on how severe the contamination is; more protective gear may be required for heavily affected areas.

4. Remediation Process

Source Control:

- Addressing the root cause of moisture is essential. This may involve fixing leaks, improving ventilation, or managing humidity.

Cleaning and Removal of Mold:

- Mold cannot just be treated with chemicals; it must be physically removed.

- Non-porous materials (like metals and glass) can often be cleaned with HEPA vacuums or damp cloths.

- Severely affected porous materials (like drywall and carpets) should be removed and disposed of according to local regulations.

- HEPA air filtration systems should be used to capture airborne mold spores during cleanup.

Cleaning Techniques:

- Common methods include HEPA vacuuming and scrubbing surfaces where mold is present.

- Antimicrobial agents may be used, but the focus is on physical removal.

5. Post-Remediation Evaluation

Final Inspection:

- After cleanup, a visual inspection ensures no visible mold remains.

- Air and surface tests may be conducted to confirm that mold levels are back to normal.

- It's crucial to check that the environment is dry to prevent mold from returning.

Documentation and Reporting:

- Detailed records of the remediation process, including testing results and cleanup procedures, should be maintained.

- This documentation is important for compliance and may be needed for insurance or legal matters.

6. Ongoing Prevention

- Educating building occupants about moisture control is vital. This includes maintaining HVAC systems, managing humidity, and promptly addressing leaks.

By adhering to the IICRC S520 standard, mold remediation professionals take a systematic and health-focused approach, ensuring that indoor spaces are restored to safe, mold-free conditions.

Do You Really Need, Need a Mold Remediation Expert in Eagle Point?

While it may be tempting to tackle mold issues on your own, hiring a professional mold remediation service can ensure a thorough and effective solution. Mold can pose serious health risks and structural damage to your home, making it crucial to address the problem with expertise. Disaster Response specializes in mold remediation, providing the knowledge and tools necessary to restore your environment safely and efficiently.

Understanding the Mold Remediation Process

Mold remediation involves a systematic approach to identify, contain, and eliminate mold growth. Professionals like those at Disaster Response utilize advanced techniques and equipment to assess the extent of the mold infestation. This process includes air quality testing, surface sampling, and moisture control measures to prevent future growth. By understanding the specific conditions that led to mold development, experts can implement effective solutions tailored to your situation.

Health Risks Associated with Mold Exposure

Mold can lead to a variety of health issues, particularly for individuals with respiratory conditions, allergies, or weakened immune systems. Symptoms may include coughing, sneezing, skin irritation, and even more severe reactions in sensitive individuals. Engaging a mold remediation expert ensures that the mold is not only removed but that the air quality in your home is restored to a safe level, protecting the health of your family.

Preventing Future Mold Growth

After remediation, it's essential to take proactive steps to prevent mold from returning. Disaster Response provides guidance on moisture control, ventilation improvements, and regular inspections to maintain a mold-free environment. By addressing the underlying causes of mold growth, such as leaks or high humidity, you can significantly reduce the risk of future infestations.

The Importance of Professional Equipment and Techniques

Attempting to remove mold without the proper equipment can lead to incomplete removal and potential health hazards. Professionals use specialized tools such as HEPA vacuums, air scrubbers, and moisture meters to ensure thorough remediation. Disaster Response's trained technicians are equipped to handle even the most challenging mold situations, ensuring that your home is restored to a safe and healthy state.

JOANA RUFO

Swept Away Restoration & Carpet Cleaning

Disaster Response Introducing Swept Away Restoration & Carpet Cleaning: The Premier Choice for Emergency Clean-Up**

At Disaster 911, we're elevating the standard with ( Swept Away Restoration & Carpet Cleaning ), our trusted go-to contractor for emergency clean-up services. While others may settle for the status quo, ( Swept Away Restoration & Carpet Cleaning ) takes an innovative approach to restoration.

From water and fire damage to mold remediation, ( Swept Away Restoration & Carpet Cleaning ) doesn't just follow industry norms-they set new ones. Our rigorous vetting process ensures that ( Swept Away Restoration & Carpet Cleaning ) exceeds expectations, delivering cutting-edge solutions for your emergency needs.

When you choose Disaster 911 and ( Swept Away Restoration & Carpet Cleaning ), you're opting for a dynamic partnership that prioritizes effective, next-level recovery. Don't settle for the ordinary-when disaster strikes, choose the best in emergency response.

PO Box 1134 Ashland, Oregon 97520

PO Box 1134 Ashland, Oregon 97520

Call Us

Call Us

Reach Out to a Mold Remediation Specialist in Eagle Point, OR, for These Mold-Related Issues

Mold growth can occur in various environments, particularly in areas with high humidity or water damage. This fungal growth can lead to significant health risks, property damage, and unpleasant odors. Recent studies have shown an increase in mold-related issues in Eagle Point, with many homeowners facing challenges in managing and eliminating mold effectively. If you find yourself dealing with any of the following mold situations, it's crucial to contact a mold remediation expert promptly:

Visible Mold Growth

If you notice mold on walls, ceilings, or other surfaces, it's a clear sign that professional intervention is needed. Mold can spread quickly and may indicate underlying moisture problems.

Musty Odors

A persistent musty smell in your home can be a strong indicator of hidden mold. This odor often suggests that mold is present, even if it's not immediately visible.

Water Damage

Following a leak, flood, or any water intrusion, the risk of mold growth increases significantly. It's essential to address any water damage promptly to prevent mold from taking hold.

Health Symptoms

If you or your family members are experiencing unexplained respiratory issues, allergies, or skin irritations, mold exposure could be the culprit. Seeking professional help can ensure a safe living environment.

Condensation Issues

Excessive condensation on windows, walls, or pipes can create a breeding ground for mold. Addressing these issues with a mold remediation service can help prevent future growth.

Previous Mold Problems

If you've dealt with mold in the past, it's vital to monitor the area for any signs of recurrence. A professional can assess the situation and implement preventive measures.

Regardless of the mold issue you're facing, it's important to understand that Eagle Point residents should act quickly to mitigate the risks associated with mold exposure. Mold can not only damage your property but also pose serious health risks to you and your family. Engaging a qualified mold remediation specialist like Disaster Response can provide the expertise needed to effectively eliminate mold and restore your home to a safe condition.

Essential Steps to Take After Discovering Mold in Your Home in Eagle Point

Finding mold in your home can be alarming and overwhelming. Mold can grow quickly and pose health risks, so it's crucial to act promptly. Here are the steps you should follow if you discover mold in your Eagle Point residence:

- Identify the source of moisture that is causing the mold growth.

- Ensure the affected area is well-ventilated to minimize exposure.

- Avoid touching or disturbing the mold, as this can release spores into the air.

- Document the extent of the mold growth with photographs for your records.

- Contact a professional mold remediation service to assess the situation.

- Follow any safety recommendations provided by the remediation experts.

- Keep children and pets away from the affected area until it has been treated.

- Review your home's ventilation and humidity levels to prevent future mold growth.

If you find mold in your home, it's essential to address it quickly to protect your health and property. Mold can lead to various health issues, including respiratory problems and allergic reactions. At Disaster Response, we specialize in mold remediation and are dedicated to restoring your home to a safe and healthy environment.

Contact Your Local Mold Remediation Experts in Eagle Point, OR, for a Free Consultation

At Disaster Response, we understand the stress and uncertainty that comes with mold issues. Our team is committed to providing you with the highest level of service and support during this challenging time. We approach every situation with professionalism, care, and urgency.

Our mold remediation specialists will work diligently to identify the source of the mold, safely remove it, and implement measures to prevent its return. When your home's safety and your family's well-being are at stake, don't settle for anything less than the best—choose Disaster Response today.

Contact Your Emergency

Disaster Response Now!

Latest News in Eagle Point, OR

Eagle Point Credit Company Inc. Prices $100 Million Public Offering of Notes

Business Wirehttps://www.businesswire.com/news/home/20241204187628/en/Eagle-Point-Credit-Company-Inc.-Prices-100-Million-Public-Offering-of-Notes

GREENWICH, Conn.--(BUSINESS WIRE)--Eagle Point Credit Company Inc. (the “Company”) (NYSE:ECC, ECCC, ECC PRD, ECCF, ECCX, ECCW, ECCV) today announced that it has priced an underwritten public offering of $100 million aggregate principal amount of its 7.75% notes due 2030 (the “2030 Notes”), which will result in net proceeds to the Company of approximately $96.5 million after payment of underwriting discounts and commissions and estimated offeri...

GREENWICH, Conn.--(BUSINESS WIRE)--Eagle Point Credit Company Inc. (the “Company”) (NYSE:ECC, ECCC, ECC PRD, ECCF, ECCX, ECCW, ECCV) today announced that it has priced an underwritten public offering of $100 million aggregate principal amount of its 7.75% notes due 2030 (the “2030 Notes”), which will result in net proceeds to the Company of approximately $96.5 million after payment of underwriting discounts and commissions and estimated offering expenses payable by the Company. The 2030 Notes will mature on June 30, 2030, and may be redeemed in whole or in part at any time or from time to time at the Company’s option on or after June 30, 2027. The 2030 Notes will be issued in denominations of $25 and integral multiples of $25 in excess thereof and will bear interest at a rate of 7.75% per year, payable quarterly, with the first interest payment occurring on March 31, 2025. The 2030 Notes are rated ‘BBB+’ by Egan-Jones Ratings Company, an independent, unaffiliated rating agency. In addition, the Company has granted the underwriters a 30-day option to purchase up to an additional $15 million aggregate principal amount of 2030 Notes to cover overallotments, if any.

The offering is expected to close on December 10, 2024, subject to customary closing conditions. The Company intends to list the 2030 Notes on the New York Stock Exchange under the symbol “ECCU”.

Lucid Capital Markets, LLC is acting as the lead bookrunner for the offering. B. Riley Securities, Inc., Piper Sandler & Co. and Janney Montgomery Scott LLC are acting as joint bookrunners for the offering. InspereX LLC and William Blair & Company, L.L.C. are acting as lead managers for the offering. Clear Street LLC and Wedbush Securities Inc. are acting as co-managers for the offering.

Investors should consider the Company’s investment objectives, risks, charges and expenses carefully before investing. The preliminary prospectus supplement dated December 3, 2024 and the accompanying prospectus dated June 9, 2023, which have been filed with the Securities and Exchange Commission (“SEC”), contain this and other information about the Company and should be read carefully before investing. The information in the preliminary prospectus supplement, the accompanying prospectus and this press release is not complete and may be changed. The preliminary prospectus supplement, the accompanying prospectus and this press release are not offers to sell these securities and are not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

A shelf registration statement relating to these securities is on file with and has been declared effective by the SEC. The offering may be made only by means of a prospectus and a related prospectus supplement, copies of which may be obtained by writing Lucid Capital Markets, LLC at 570 Lexington Ave., 40th Floor, New York, NY 10022, by calling toll-free at 646-362-0256 or by sending an e-mail to: prospectus@lucid.com; copies may also be obtained for free by visiting EDGAR on the SEC’s website at http://www.sec.gov.

Egan-Jones Ratings Company is a nationally recognized statistical rating organization (NRSRO). A security rating is not a recommendation to buy, sell or hold securities, and any such rating may be subject to revision or withdrawal at any time by the applicable rating agency.

ABOUT EAGLE POINT CREDIT COMPANY

The Company is a non-diversified, closed-end management investment company. The Company’s primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation, primarily by investing in equity and junior debt tranches of collateralized loan obligations. The Company is externally managed and advised by Eagle Point Credit Management LLC.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the prospectus and the Company’s other filings with the SEC. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Contacts

Investor Relations: ICR 203-340-8510 ir@EaglePointCredit.com www.eaglepointcreditcompany.com

Disclaimer:

Call us 877-451-9251

Call us 877-451-9251 Request Information

Request Information